Social Security System is a Philippine government agency that provides retirement and health benefits to all paid up employees, self-employed, voluntary and OFW.

As a Members of the SSS you can file a 'salary' or 'calamity' loans. salary loans is depend on the monthly salary of the employee and calamity loans are can be used when there is a calamity that has been declared by the government in the area where the SSS member lives, such calamity are as followed Super Typhoon, flooding, earthquake and natural disasters.

For senior citizen, they can remit their pension once they reach their retirement age.

Read: How to File SSS Loan Online

1. Employee - if you are a regular employee, your employer has the obligation to pay your monthly contribution which will deduct on your salary. A 50/50 share will be deposit on your monthly contribution.

2. Voluntary member, self-employed and OFW – are those member who give contribution from minimum contribution to their desired contribution.

Note: the higher the contribution, the higher you will get it any purpose it may serve

How to pay SSS contribution for Voluntary/Self Employed member

1. Go to the nearest SSS branch where you lived.

2. Go to information desk or ask the guard and ask for RS-5 form or contributions payment form.

3. Fill up the necessary details in the form.

4. Submit to cashier for checking and payment. (P550.00 is the minimum payment for self-employed, voluntary member and OFW)

5. That’s it.

How to Pay in Bayad Center

Paying SSS contribution in Bayad Center (ex. LBC, Western Union and others), accept payment for SSS contribution unless if your monthly contribution is updated if not they will not accept any payment. It should be always updated, so pay always on time to avoid going to any SSS Branch for your convenience.

After the payment, your contribution will appear in your ESI, 3 days of working days and a text will be receive from the SSS for the confirmation of your contribution.

How to Open Your ESI or Employee Static Information

1. Go to the website www.sss.gov.ph

2. Register first if you don’t have account? Or just Log-in if you have already have.

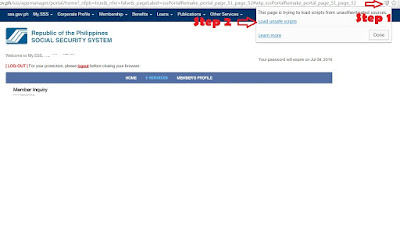

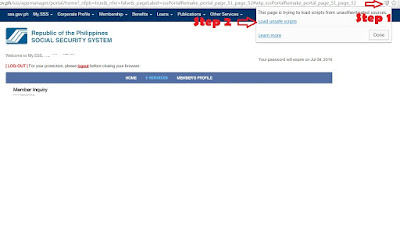

3. Once Log-in, click Inquiry under E-services tab.

4. For unsupported browser an instruction will pop up at the center of the screen, just click Ok to reload the page .

5. Click Step 1, where you can see the shield icon, then Click Step 2 to reload the page.

6. If everything went alright? you can now vie your Employee Static Information or ESI. click the Actual Premiums under the Member Info tab to proceed to your updated monthly contributions.

7. You can now check your latest monthly contribution and to see to it that all contributions are updated.

As a Members of the SSS you can file a 'salary' or 'calamity' loans. salary loans is depend on the monthly salary of the employee and calamity loans are can be used when there is a calamity that has been declared by the government in the area where the SSS member lives, such calamity are as followed Super Typhoon, flooding, earthquake and natural disasters.

For senior citizen, they can remit their pension once they reach their retirement age.

Read: How to File SSS Loan Online

Read: SSS Loan Online Application

There are many ways on how to contribute as SSS member1. Employee - if you are a regular employee, your employer has the obligation to pay your monthly contribution which will deduct on your salary. A 50/50 share will be deposit on your monthly contribution.

2. Voluntary member, self-employed and OFW – are those member who give contribution from minimum contribution to their desired contribution.

Note: the higher the contribution, the higher you will get it any purpose it may serve

How to pay SSS contribution for Voluntary/Self Employed member

1. Go to the nearest SSS branch where you lived.

2. Go to information desk or ask the guard and ask for RS-5 form or contributions payment form.

3. Fill up the necessary details in the form.

4. Submit to cashier for checking and payment. (P550.00 is the minimum payment for self-employed, voluntary member and OFW)

5. That’s it.

How to Pay in Bayad Center

Paying SSS contribution in Bayad Center (ex. LBC, Western Union and others), accept payment for SSS contribution unless if your monthly contribution is updated if not they will not accept any payment. It should be always updated, so pay always on time to avoid going to any SSS Branch for your convenience.

After the payment, your contribution will appear in your ESI, 3 days of working days and a text will be receive from the SSS for the confirmation of your contribution.

How to Open Your ESI or Employee Static Information

1. Go to the website www.sss.gov.ph

2. Register first if you don’t have account? Or just Log-in if you have already have.

3. Once Log-in, click Inquiry under E-services tab.

4. For unsupported browser an instruction will pop up at the center of the screen, just click Ok to reload the page .

5. Click Step 1, where you can see the shield icon, then Click Step 2 to reload the page.

6. If everything went alright? you can now vie your Employee Static Information or ESI. click the Actual Premiums under the Member Info tab to proceed to your updated monthly contributions.

7. You can now check your latest monthly contribution and to see to it that all contributions are updated.

Sample Contributions

Take Note: Always remember to update or pay your monthly contributions, it may help us in the near future needs and always update your account especially the password in their website so that you can access the site anytime.

kindly comment below for your question....